Little Known Facts About Debt Collection Laws.

It is normally smart to file a solution to the issue. You intend to see a failure of the computations the creditor has actually made use of. If you disagree with the quantity they declare you owe, for instance, you can compose "I differ with the amount owed" on your Solution form, sign it and also file it with the Court where the problem was filed.

You can usually file your Response on or prior to the return day detailed on the Summons. If you file an Answer, the Court will set the matter for trial at some point in the future, possibly 30-90 days later on. Throughout that time duration, you can attempt to bargain with the lender, and also if those arrangements breakdown, you can go to test as well as compel them to confirm that you certainly owe the amount they declare.

Colorado Collection law practice that Stephen Craig has experience handling consist of: Machol & Johannes, Silverman & Borenstein, Farrell and also Seldin, Sawaya, The Rose Law Workplace (Richard Rose), David Bauer, P. Scott Lowery, Vinci Regulation Workplace, Don Perlmutter, Vargo Myers Janson, Greenberg and also Sada. Other collection firms of Colorado we deal with include Wakefield & Associates as well as Liberty Acquisitions.

If you think your financial institutions are crossing the line, it's time to call our financial obligation negotiation attorneys. Allow us show you exactly how you can lastly place an end to the legal actions, collections, and also lender harassment. When you can not pay on your individual financial obligations, it may feel like your lenders will stop at nothing obtain what they are owed.

The 45-Second Trick For Debt Collection Laws

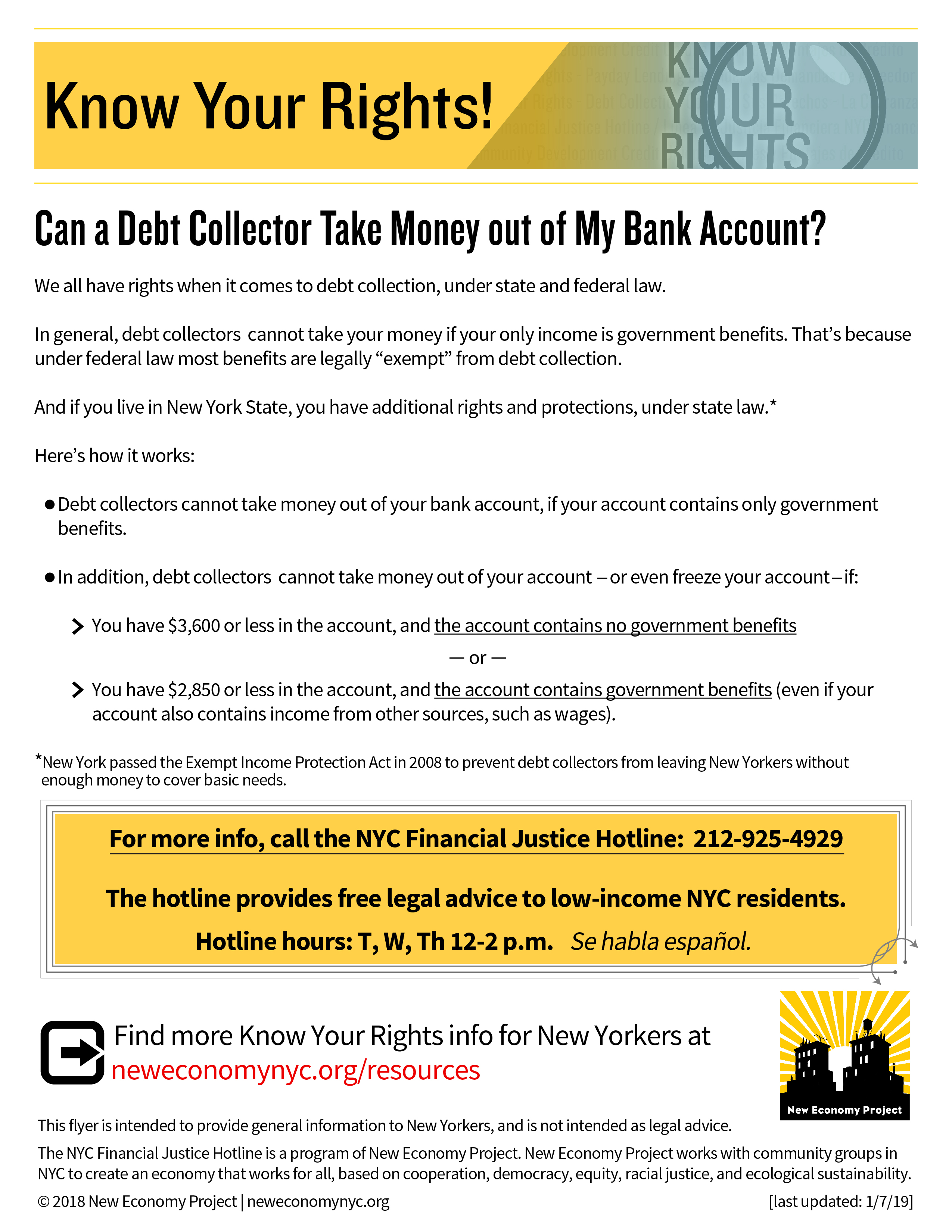

A financial institution has the time and resources to go to court, however you might not be in a position where you can combat back. A lender may likewise sell your financial obligation to a third-party financial debt enthusiast. Financial obligation collection agencies can-- as well as will-- contact you personally, by mail, as well as on the phone. They aren't intended to call you prior to 8 am or after 9 pm, but many financial debt collection agencies don't comply with these rules and call in any way hours of the day or night.

Some have even declared to be police, and also endangered that people will certainly be "detained" if they do not pay. Rather than obtaining associated with a lengthy, expensive suit, your finest choice may be to get an automated keep. An automatic remain stops creditors as well as financial debt collection agencies in their tracks. They won't be able to file suits, proceed existing suits, make call, or send letters to gather on financial debts or reclaim your valuables.

You don't require an unique court order. As soon as the remain is in effect, the creditors can't do anything up until you and also your attorney have actually generated a plan to eliminate your financial obligations. You will not have to bother with anymore harassment by financial obligation collectors - debt collection laws. You can finally sleep in the evening understanding that the financial institutions have vanished.

Gary Gibson with the Law Practice of Carabin Shaw safeguards people that have actually been filed a claim against on credit history card financial obligation and/or claimed financial debt. Significantly, financial obligations are being sold by lenders in mass quantities to "financial obligation buyers". Financial obligation customers typically acquire defaulted bulk consumer obligations for pennies on the dollar and after that file a huge volume of legal actions on the purported debts, asserting to be an assignee of the debts.

5 Easy Facts About Debt Collection Laws Explained

Gathering on a financial obligation is not a simple process, particularly for a financial debt purchaser. The regulation requires the complainant to show that it owns the customer's specific account. Also if the collection agency can get over that difficulty, it should show that the sum it looks for to accumulate not just is allowable under the created agreement with the financial institution, however also correct in amount.

It is not wise for a customer to represent himself or herself in such situations. The financial obligation collection agency has an attorney, therefore must you. Likewise, financial debt collection typically results in infractions of the reasonable financial debt collection regulations. Customers typically do not recognize it, and believe that they are being "outsmarted" by the collection attorney.

A great deal of sincere, upstanding people are encountering hard economic scenarios in the existing economic climate - debt collection laws. Insolvency is an option that helps some, however it is not the best service for everyone seeking a means out of overwhelming debt. Repaying existing accounts-- even without incurring brand-new debt-- can suggest years or perhaps decades of paying the debt and the proceeding high rate of interest charged.

At our law office, we provide free consultations for individuals searching for practical options. There is no pressure at Mc Carthy Legislation. There is no blame assigned. Our legal representatives pay attention with regard and issue in all conversations regarding your financial debts and the remedies you have open to you. In some instances the solution might be financial obligation settlement, however, for others, you might need to look much deeper right into various other choices like personal bankruptcy.

browse around these guys like this my latest blog post